3 big ways the debt ceiling and default fight affect you and your Social Security, loans, 401k, more

Time is dwindling for lawmakers to raise the debt ceiling before the country runs out of money to pay its bills − something that has never happened before but could happen this year as early as June 1.

President Joe Biden met with top congressional leaders Tuesday to discuss an impending, first-of-its-kind default as debt ceiling brinksmanship continues in Washington. Because the country has never defaulted on its obligations before, it is unclear how deeply it would affect the U.S. economy.

Consequences could include “defaulting on interest payments that are due on the debt or payments due for Social Security recipients or to Medicare providers,” Treasury Secretary Janet Yellen said on ABC’s “This Week.”

“We would simply not have enough cash to meet all of our obligations. And it’s widely agreed that financial and economic chaos would ensue,” she added.

Here's what it could mean for you:

Stay in the conversation on politicsSign up for the OnPolitics newsletter

Social Security, Medicare, federal salaries at risk if U.S. defaults

The Treasury department makes millions of payments per day, all of which would be in jeopardy if the government runs out of money.

“The most direct effect is that some people who are owed money from the federal government may not get paid,” Shai Akabas, director of economic policy at the Bipartisan Policy Center, told USA TODAY. Those payments include Social Security, Medicare, Medicaid, federal salaries, food stamps and more.

The Treasury could have to prioritize or delay certain payments but considering a default would be uncharted territory, Akabas said it is difficult for the Treasury to pick and choose which payments to make because so many families rely on the government’s various payments.

“These are of course important programs that many American households rely upon,” Akabas said. “In a world where some of those payments are not arriving on time, it is clearly going to cause disruption for many household budgets.”

Going hungry:Millions struggling as GOP debt ceiling plan would cut SNAP benefits

Economist: 'Interest rates will spike' across the board

If lawmakers cannot come to an agreement before the government runs out of cash to pay its debts, interest rates could surge across the board, experts say.

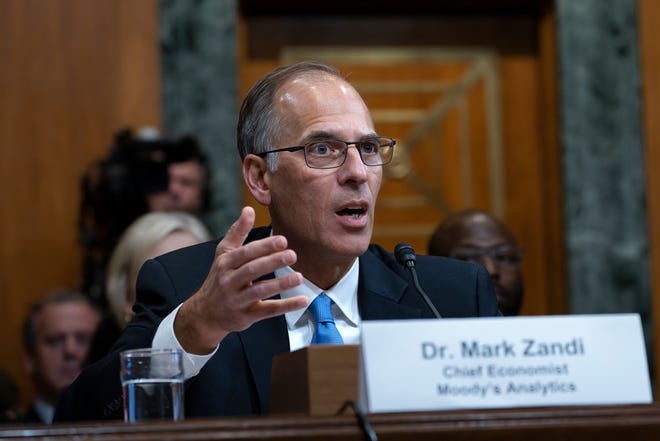

“If policymakers actually do fail to increase or suspend the limit before the Treasury runs out of cash and defaults on its obligations, interest rates will spike and stock prices will crater, with enormous costs to taxpayers and the economy,” Mark Zandi, chief economist of Moody’s Analytics, testified in March to the Senate Banking Committee.

Those interest rates extend to credit cards, mortgage rates and other borrowing costs, such as personal and auto loans.

U.S. default could extend to retirement savings including 401(k) plans and pensions

Should the U.S. default, investor confidence could plummet and result in instability in the stock markets which would hurt investments such as 401(k) plans and pensions, but it is also unclear how the markets would react.

“I would guess that investors will not be comforted by the U.S. government’s failure to meet its obligations . . . It will depend on lots of exogenous factors but it could be quite severe,” Akabas said of the potential impact a default could have on people’s retirement savings.

Because a default is so unusual, it is possible the U.S. could slip into a recession given there could be “chaos” going on in financial markets, Akabas said. A default could push businesses to stop hiring and investing, which would significantly slow economic growth and possibly lead to high unemployment.

RelatedWhat do interest rate hikes mean for student loans?

No comments: