North Carolina House approves Blue Cross Blue Shield reorganization bill

The NC reorganization bill would allow BCBS to act more competitively against its for-profit rivals

North Carolina’s leading health insurer would be able to reorganize through a method the nonprofit company’s leaders said would keep it nimble and competitive with for-profit rivals, under legislation approved Thursday by the state House.

The measure, which would allow Blue Cross Blue Shield of North Carolina and a dental insurance provider to complete a restructuring through creating parent holding companies, passed with bipartisan support despite strong criticism from state Insurance Commissioner Mike Causey.

"The intent of the bill is to create a more level playing field for those two" entities, said Rep. John Bradford, a Mecklenburg County Republican who shepherded the legislation in the House. "The health care industry is fiercely competitive and rapidly changing."

BIPARTISAN NORTH CAROLINA BILL THAT WOULD RESTRUCTURE BLUE CROSS AND BLUE SHIELD ADVANCES IN STATE HOUSE

After an 86-26 House vote for passage, the bill now heads to the Senate.

The measure would permit Blue Cross, the state's dominant insurance provider, and Delta Dental to transfer money and other investments from its current hospital service companies into new shell companies run by the same executive leadership. Blue Cross could use those assets to purchase other companies to expand services, for example. The proposed holding companies would remain fully taxed nonprofits.

But Causey, a Republican, said shifting assets could allow Blue Cross to circumvent a state law that limits its reserves and would eventually require the company to refund some of that money to its policyholders, which number over 4 million, or lower its rates.

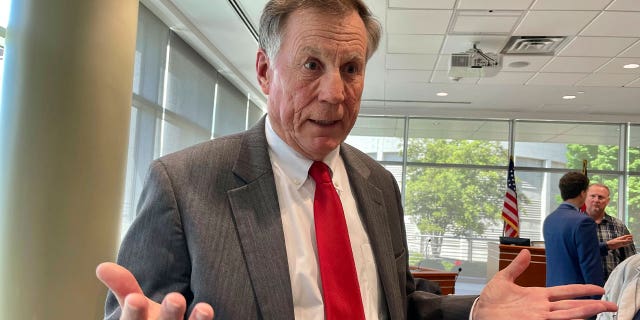

North Carolina Insurance Commissioner Mike Causey talks to reporters about a bill that would let Blue Cross Blue Shield reorganize on April 24, 2023, in Raleigh, North Carolina. (AP Photo/Hannah Schoenbaum) (AP Photo/Hannah Schoenbaum)

Other bill opponents also said they’re worried that the change could contribute to higher premiums, especially for many lower-income people who rely on Blue Cross products.

"It’s a lot of North Carolinians that are impacted by this bill," said Rep. Deb Butler, a New Hanover County Democrat, who urged more work on the measure. "And if we get this wrong, it’s going to be a disastrous situation."

Blue Cross trustee board Chair Ned Curran told House members in a letter dated Wednesday that there was nothing in the measure that would increase premiums, and that Causey still has the authority to approve or deny premium rates.

NEBRASKA BILL WOULD ALLOW HEALTHCARE PROVIDERS TO 'CONSCIENTIOUSLY OBJECT' TO PROCEDURES

Curran and Bradford also pointed to changes made to the original bill that could address concerns by Causey’s Insurance Department, the North Carolina Medical Society and others.

The bill "will improve the health and well-being of North Carolina and its communities," Blue Cross said in a news release thanking House members for the vote.

A change this week caps the amount of the company's "admitted assets" to be transferred at the reorganization to the new holding company at 25%. The holding company also would have to file annual audited financial statements with Causey, disclose compensation for its highest paid executives and reveal the company's "strategic investment activities."

The reorganization option "is something that is needed by a North Carolina company," said Rep. Jason Saine, a Lincoln County Republican and a senior budget-writer. "And we’ve worked hard to reduce regulations and make it easier for companies in our state to do business. This is the same process."

Majority Leader John Bell of Wayne County and Minority Leader Robert Reives of Chatham County also are among the chief bill sponsors. Senate leader Phil Berger expressed support for a reorganization proposal this week.

For decades, Blue Cross was able to accumulate assets tax-free until a federal law ended its long tax exemption in 1986. The insurer is subject to more regulations than for-profit companies operating in the state, including a mandate of higher reserves.

A law passed in the late 1990s would require Blue Cross to transfer its total worth in stock to a charitable foundation should it ever convert to a for-profit company, with the proceeds designed to improve health care for state residents. The bill says the value of the holding company envisioned would be part of that value calculation.

Blue Cross is a major policy player at the General Assembly, where it has more than a dozen registered lobbyists. Its employee PAC gave over $250,000 to legislative campaign committees in 2022, according to reports filed with the State Board of Elections

No comments: